However drawings dont only cover cash withdrawals. Saskatchewan Canada I have been making a general journal entry each month to document owners draw.

Drawings Journal Entry Goods Cash With Examples Accountingcapital

The uses of business assets for domestic purposes are also considered as drawings.

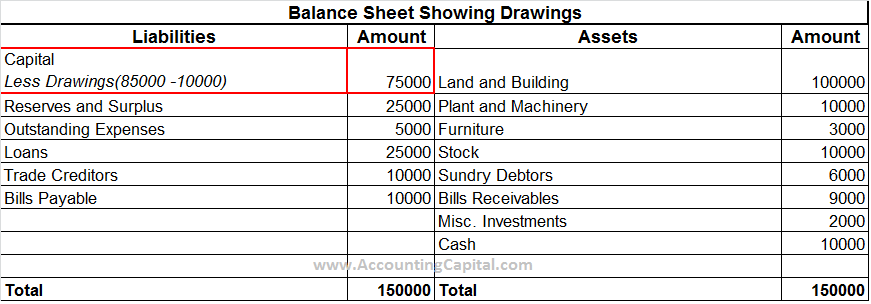

. The value at the lower right is subject to use tax if your state requires it most do. Drawings reduce the amount of capital on the other hand. Compare features and functionality between Fusion 360 for personal use and Fusion 360 below.

Goods taken for personal use is also known as goods taken for private use goods taken for domestic use cash withdrawn for private use. When it comes to paying you would select a holding account as the deposit to account. In this video you will learn that A withdrawal of cash for an owners personal use and how to make Drawings entry.

The word drawings refer to a withdrawal of cash or other assets from the proprietorshippartnership business by the OwnerPromoter of the businessenterprise for its personal use. A drawing in accounting terms includes any money that is taken from the business account for personal use. The withdrawal of cash by the owner for personal use is placed on a temporary drawings account and reduces the owners equity.

When the owner of a business takes goods from the business for their own use those items must be accounted for. Owners Personal Use of Inventory. In accounting assets such as Cash or Goods which are withdrawn from a business by the owner s for their personal use are termed as drawings.

Aim to use a 2B or 3B to start your drawing and switch to a softeror blackerpencil such as a 6B or a 9B for deeper tones. This is an example of the monthly entry Ive been making. Generally you would record stock taken by a director in two ways.

Inventory at the end of period. This can be the equivalent of a salary or it can be as simple as lunch paid for with your company credit card. Drawings Account 120500 620.

It reduces the total capital invested by the proprietor s. A Drawing Account to be debited and Purchases Account to. Drawings can occur by withdrawing cash from a business account but can also include anything that is considered a business asset such as products or equipment that is removed from the business for personal use by the owners.

To even out the workload Nance travels around the country inspecting their properties. 100 20 60 60. Failing to account for goods taken by the owner would create potentially misleading accounts with goods taken for the owners use appearing as stock loss.

So my accounting equation. Taking Goods For Personal Use. The partners split profits and losses equally and each takes an annual drawing of 80000.

0 60 20 40. It is not an expense of the business. On the other hand profits earned by the business increase owners capital.

Any such withdrawals made by owner leads to a reduction in owners equity invested in the Enterprise. Up to 7 cash back Fusion 360 for personal use. Fusion 360 for personal use is a limited free version that includes basic functionality and can be renewed on a 3-year basis.

Stock taken for personal use journal entry. Drawings are the amounts taken by the owner of a business for his personal use in anticipation of profit. Owner uses inventory after it is entered into QuickBooks.

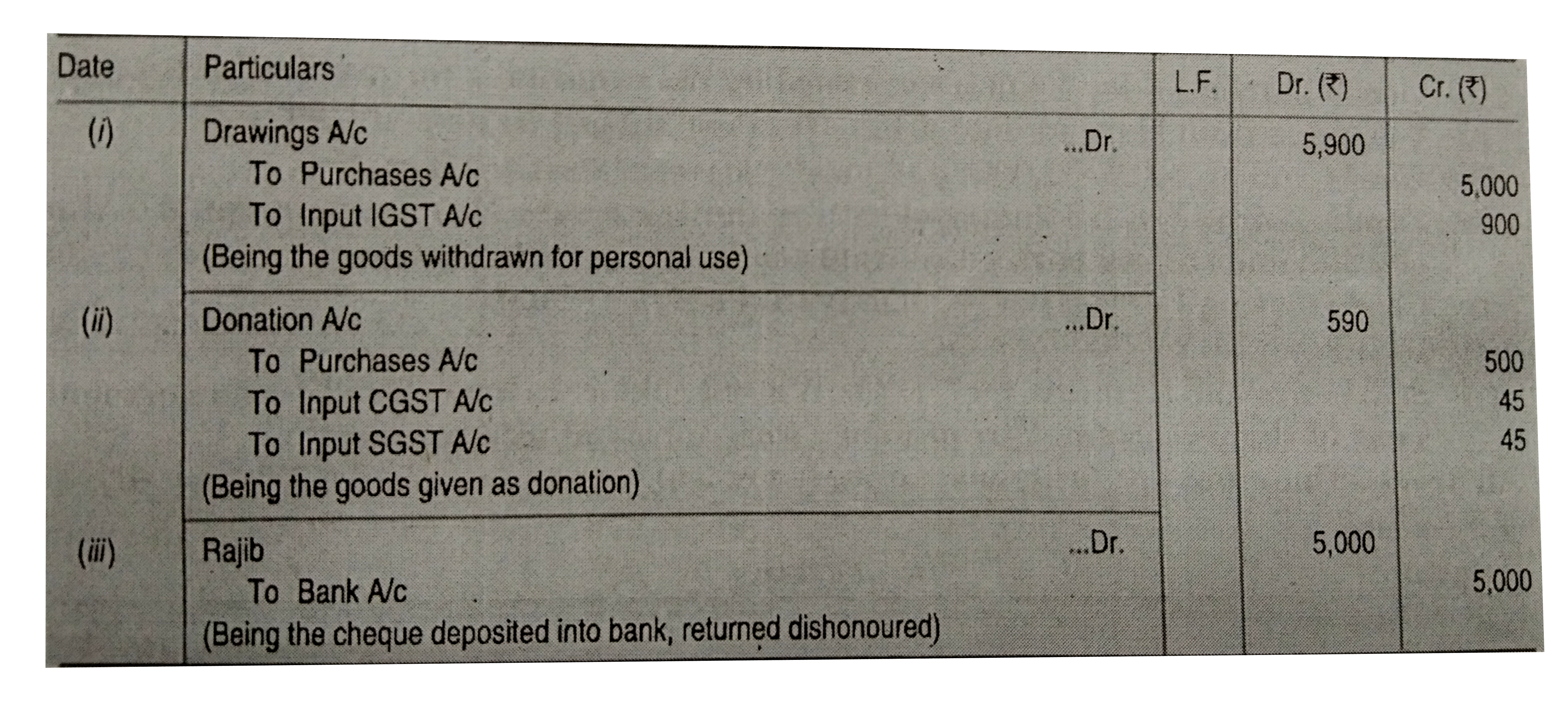

Purchases Account 500. Option 1 Create the director a customer card and record the sale as per normal. Recording - Journal Entry Drawings of stock is also an accounting transaction and has to be brought into the books of accounts through a journal entry.

Most mechanical pencils also known as clutch or propelling pencils are good for precision work but. Try it free for 7 days. Profit 100 40 60.

Proprietor Mr A withdrew cash 120 and goods worth 500 for personal use. Amount or moneys worth goods withdrawn by the proprietor for his personal private or domestic use is known drawings. It is also called a withdrawal account.

Drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes. Goods costing Rs10000 taken by the proprietor for personal use were credited to sales account while passing rectifying entry. Credit Cash is withdrawn from the business and taken by the owner.

Keep track of the money you withdraw for personal use easily with Debitoor bookkeeping software. Symington manages the business and serves as the accountant. If the company is taxed as a sole proprietor or partnership - inventory adjust set the adjusting account to ownerpartner equity drawing lower the qty on hand.

From time to time they use small amounts of store merchandise for personal use. Drawings are the amounts taken by the owner of a business for his personal use in anticipation of profit. If in this period i took 10 from inventory for personal using the BPP book says the double entry for this entry is.

Debit - Drawings ac Drawings ac represents the owner. Drawings are usually made in the form of cash but there could be other assets or goods withdrawn by the owner for his personal use. I understand how cash is to be entered but not how personal use of inventory is to be entered.

Debit Drawing Account. Drawings are usually made in the form of cash but there could be other assets or goods withdrawn by the owner for his personal use.

Goods Withdrawn For Personal Use Double Entry Bookkeeping

Record The Following Transactions In A Journal I Withdrawn Goods For Personal Use Youtube

Journalise The Following Transactons 2006 December 31 Goods Withdrawn By The Proprietors For His Personal Use Rs 120 Sarthaks Econnect Largest Online Education Community

Arpit Withdrew Goods Costing 21000 Sp 28000 On 1feb2017 For Personal Use He Also Withdrew 40000 Out Of Capital Accountancy Accounting For Partnership Basic Concepts 12864933 Meritnation Com

Drawings Journal Entry Goods Cash With Examples Accountingcapital

Record The Following Transactions In A Journal I Withdrawn Goods For Personal Use Cost Rs 5 000 Igst 18 Sale Price Rs 7 000 Ii Goods Costing Rs 500 Given As Donation These Goods Were Purchased

0 comments

Post a Comment